Business Valuation News | August 2018

In recent Federal Court case of City of Hialeah Employees Retirement System v. FEI Co. (Case No. 3:16-cv-1792 SI (January 25, 2018 – LEXIS 11989), Plaintiff’s alleged that members of FEI’s Board of Directors and Management team relied on lower projects in their Proxy Statement and associated Fairness Opinion executed by their financial advisor, Goldman Sachs. The Court rejected Plaintiff’s arguments; however, this case highlights a critical issue in certain appraisal engagements in adverse proceedings.

Case No. 3:16-cv-1792-SI (January 25, 2018- LEXIS 11989)

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF OREGON

CITY OF HIALEAH EMPLOYEES’ RETIREMENT SYSTEM, Individually and on Behalf of All Others Similarly Situated,,

Plaintiff,

v.

FEI COMPANY, THERMO FISHER SCIENTIFIC INC., THOMAS F. KELLY, DONALD R. KANIA, HOMA BAHRAMI ARIE HUIJSER, JAN C. LOBBEZOO, JAMI K. DOVER NACHTSHEIM, JAMES T. RICHARDSON AND RICHARD H. WILLS,

Defendants.

Case No. 3:16-cv-1792-SI

OPINION AND ORDER

Gary M. Berne, Jennifer S. Wagner, and Nadia H. Dahab, STOLL STOLL BERNE LOKTING & SCHLACHTER P.C., 209 S.W. Oak Street, Fifth Floor, Portland, OR 97204; A. Rick Atwood, Jr., David T. Wissbroecker, ROBBINS KELLER RUDMAN & DOWD LLP, 655 West Broadway, Suite 1900, San Diego, CA. Of Attorneys for Plaintiff.

Philip S. Van Der Weele and Kara M. Borden, K&L GATES LLP, One SW Columbia Street, Suite 1900, Portland, Or 97258; B. John Casey, STOEL RIVES LLP, 760 SW Ninth Avenue, Suite 3000, Portland, OR 97205. Of Attorneys for Defendant Thermo Fisher Scientific Inc.

David Angeli and Kristen Tranetzki, ANGELI LAW GROUP, 121 S.W. Morrison Street, Suite 400, Portland, OR 97204; Boris Feldman, Keith E. Eggleton, and Michael R. Petrocelli, WILSON SONSINI GOODRICH & ROSATI, 650 Page Mill Road, Palo Alto, CA 94304. Of PAGE 2 – OPINION AND ORDER Attorneys for Defendant FEI Company, Thomas F. Kelly, Donald R. Kania, Homa Bahrami, Arie Huijser, Jan C. Lobbezoo, Jami K. Dover Nachtsheim, James T. Richardson, and Richard H. Willis.

Michael H. Simon, District Judge.

On March 7, 2017, Plaintiff City of Hialeah Employees’ Retirement System (“Plaintiff”) filed a Second Amended Complaint (“SAC”) against Defendant Companies FEI Company (“FEI”) and Thermo Fisher Scientific Inc. (“Thermo”), as well as named Individual Defendants Thomas Kelly, Donald Kania, Homa Bahrami, Arie Huijser, Jan Lobbezoo, Jami Dover Nachstsheim, James Richardson, and Richard Wills (collectively, “Defendants”) bringing claims under § 14(a) and § 20(a) of the 1934 Securities and Exchange Act (“The 1934 Act”). Before the Court is Defendant FEI and Individual Defendants’ motion to dismiss Plaintiff’s SAC, and Defendant Thermo’s motion to dismiss Plaintiff’s SAC. For the following reasons, the Court grants Defendant FEI and Individual Defendants’ motion to dismiss and also grants Defendant Thermo’s motion to dismiss.

STANDARDS

A motion to dismiss for failure to state a claim may be granted only when there is no cognizable legal theory to support the claim or when the complaint lacks sufficient factual allegations to state a facially plausible claim for relief. Shroyer v. New Cingular Wireless Servs., Inc., 622 F.3d 1035, 1041 (9th Cir. 2010). In evaluating the sufficiency of a complaint’s factual allegations, the court must accept as true all well-pleaded material facts alleged in the complaint and construe them in the light most favorable to the non-moving party. Wilson v. HewlettPackard Co., 668 F.3d 1136, 1140 (9th Cir. 2012); Daniels-Hall v. Nat’l Educ. Ass’n, 629 F.3d 992, 998 (9th Cir. 2010). To be entitled to a presumption of truth, allegations in a complaint “may not simply recite the elements of a cause of action, but must contain sufficient allegations PAGE 3 – OPINION AND ORDER of underlying facts to give fair notice and to enable the opposing party to defend itself effectively.” Starr v. Baca, 652 F.3d 1202, 1216 (9th Cir. 2011). All reasonable inferences from the factual allegations must be drawn in favor of the plaintiff. Newcal Indus. v. Ikon Office Solution, 513 F.3d 1038, 1043 n.2 (9th Cir. 2008). The court need not, however, credit the plaintiff’s legal conclusions that are couched as factual allegations. Ashcroft v. Iqbal, 556 U.S. 662, 678-79 (2009).

A complaint must contain sufficient factual allegations to “plausibly suggest an entitlement to relief, such that it is not unfair to require the opposing party to be subjected to the expense of discovery and continued litigation.” Starr, 652 F.3d at 1216. “A claim has facial plausibility when the plaintiff pleads factual content that allows the court to draw the reasonable inference that the defendant is liable for the misconduct alleged.” Iqbal, 556 U.S. at 678 (citing Bell Atl. Corp. v. Twombly, 550 U.S. 544, 556 (2007)).

BACKGROUND

Defendant FEI is an Oregon corporation that designs, manufactures and supports a broad range of high-performance microscopy workflow solutions that provide images and answers at the micro-, nano-, and picometer scales. Defendant Thermo Fisher is a Delaware corporation that provides products and services to customers in a variety of scientific fields. On September 19, 2016, FEI was acquired by Thermo Fisher and became its wholly owned subsidiary. The Individual Defendants were members of FEI’s management and board of directors (“the Board”) before its merger with Thermo. Plaintiff Hialeah Employees’ Retirement System is a former shareholder of FEI.

A. FEI Projections and Performance

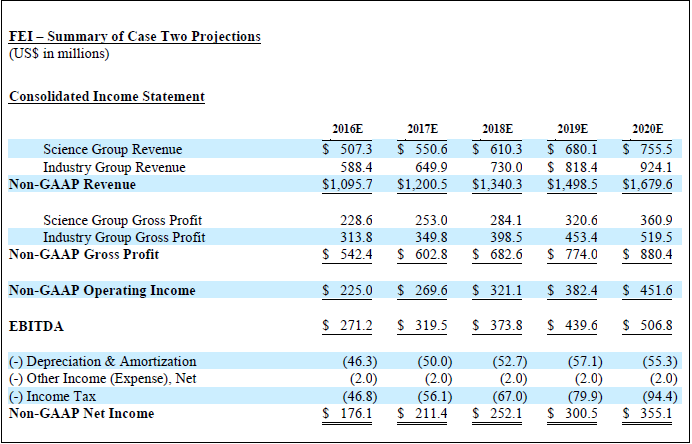

In the fall of 2015, FEI engaged in its annual, comprehensive strategic and financial review and planning process. As part of that process, FEI management prepared two sets of PAGE 4 – OPINION AND ORDER projections (jointly, “the Management Projections”). One set (“the Higher Projections”) was compiled by aggregating department-specific projections made by managers at various business units across FEI. The other set (“the Lower Projections”) modified the Higher Projections downward by “applying adjustments developed by FEI senior management to reflect FEI grouplevel dynamics.” 1 The Board used the Higher Projections in the acquisition of DCG Systems, Inc. in December 2015 and updated both sets of Management Projections after that acquisition.

FEI reported strong earnings for the fourth quarter of 2015 and first quarter of 2016. On February 2, 2016, FEI reported record revenue for the fourth quarter of 2015. Revenue for that quarter was up 8.2% compared with fourth quarter 2014. FEI’s CEO, Defendant Kania, announced that he expected “improved organic revenue growth driving increased earnings and cash flow for FEI” in 2016. On May 4, 2016, FEI reported that it had exceeded its revenue projections for the first quarter of 2016 and saw a revenue increase of 3.5%, compared with the first quarter of 2015. The earnings per fully diluted share (EPS) for the first quarter of 2016 were $0.56, at the top end of the February 2016 projections of an EPS range of $0.46 to $0.57. Defendant Kania commented that “[o]ur record backlog positions us for accelerated revenue and profitability growth as 2016 progresses.”

B. Merger Negotiations

On February 2, 2016, Marc Casper, the president and CEO of Thermo Fisher, called defendant Kania, FEI’s President and CEO, to express Thermo Fisher’s interest in discussing a potential strategic transaction with FEI. Kania then notified the Board of Casper’s message and interest. On February 4, 2015, Kania and defendant Kelly, the chairman of the Board, met with Goldman Sachs about their possible retention as FEI’s financial advisor. In response to a conflict questionnaire sent by FEI’s general counsel, Goldman Sachs disclosed that it had received approximately $7 million in fees from Thermo over the past two years. The Board determined that these past fees would not create a conflict of interest that would jeopardize Goldman’s ability to effectively advise the Board. The Board entered into an agreement with Goldman Sachs to provide financial advice to the Board. Of the fees that FEI agreed to pay Goldman, $10 million was contingent on the announcement of a merger, and $35 million was contingent on the closing of the merger.

1 The Court takes judicial notice of the proxy statement at issue in this dispute under the doctrine of incorporation by reference. In re Silicon Graphics Inc. Sec. Litig., 183 F.3d 970, 986 (9th Cir. 1999) (a district court may consider documents “whose contents are alleged in a complaint and whose authenticity no party questions, but which are not physically attached to the [plaintiff’s] pleadings.”) (quoting Branch v. Tunnell, 14 F. 3d 449, 454 (9th Cir. 1994)).

Shortly after entering into the agreement with Goldman Sachs, FEI provided the firm with a copy of the updated Management Projections. Neither FEI nor Goldman Sachs expressed a view that one set was better or more realistic than the other. On February 10 and 11, 2016, the Board held a meeting in which Goldman Sachs discussed the Management Projections. At that meeting, no Board member expressed the view that one projection was more reasonable than the other.

On March 21, 2016, Thermo made an initial, non-binding proposal of an acquisition price of $96.00 per share in cash. The same day, the Board determined that the proposal was “insufficient in comparison to the value embodied in the Company’s standalone plan.” Again, no Board member took the view that the Higher Projection was less realistic than the Lower Projection. On April 15, 2016, Thermo sent FEI a revised non-binding indication of interest proposing to acquire FEI at a price of $103.00 per share in cash. The Board held a meeting to discuss the proposal the next day and decided to explore whether FEI could obtain a better price from a different party.

Between April 16, 2016 and April 18, 2016, Goldman Sachs contacted three parties to explore their interest in a potential acquisition. One of the parties declined. Two of the parties executed confidentiality agreements containing standstill provisions. On April 28, the Board authorized Goldman Sachs to engage in transaction discussions with Thermo and the other two parties.

On April 20, 2016, Kania told Casper that Thermo’s offer of $103.00 per share was insufficient. In an effort to “convey the intrinsic value of FEI” to Thermo, FEI provided Thermo with the Higher Projections. On April 29, Kania and FEI’s CFO met with Thermo’s senior management and made presentations on FEI’s business, products, ongoing strategy and vision, financials and outlook. On May 5th, one of the other parties engaged in transaction discussions informed FEI that they were no longer interested in continuing discussions.

On May 12, 2016, Thermo raised its offer to acquire FEI to $105.00 per share. The same day, the second party that had engaged in transaction discussions informed FEI that they were no longer interested in continuing discussions. The Board met to discuss Thermo’s offer the next day. At this point, the Board began calling the Higher Projections unrealistic. Plaintiff alleges that the Board knew that using the Lower Projections would result in a lower estimate of the intrinsic value of FEI, thereby making a share price close to $105.00 appear fair. Later that day, Kania made a counteroffer to Thermo of $110.00 per share. The next day, Thermo offered $107.50 per share. The Board accepted this offer on May 16, 2016.

On May 26, 2016, the Board met with Goldman Sachs, which provided the financial analysis that would ultimately appear in a proxy statement disseminated to shareholders (“the Proxy”). Based on its analysis of the Lower Projections, Goldman Sachs told the Board that $107.50 per share was a fair price (the “Fairness Opinion”). The Board unanimously approved the Acquisition and recommended the Acquisition to FEI’s shareholders for approval.

Plaintiff alleges that as a result of the Acquisition, the Individual Defendants expected to secure liquidity for hundreds of thousands of shares of illiquid FEI stock, valued at more than $42.8 million combined. Other material benefits accruing to the Board, Plaintiff alleges, included the accelerated vesting of their unvested stock options and unvested restricted stock units. This benefit was not available to other stockholders. Further, members of management were to receive up to $29 million in change-of-control benefits upon the closing of the merger, and received salary increases and tens of thousands of additional shares of restricted stock on the eve of the signing of the merger.

C. Proxy

On July 27, 2016, FEI’s Board filed and disseminated the Proxy to the Company’s shareholders. The Proxy recommended that the Company’s shareholders vote in favor of the Acquisition. The Proxy contained both sets of Management Projections, but explained that the Board had directed Goldman Sachs to base its analysis for the Fairness Opinion on the Lower Projections because those “were more likely to reflect the future business performance of FEI on a standalone basis than would the [Higher Projections].” The Proxy elaborated on this decision:

[T]he Board of Directors considered that the [Higher Projections] were compiled based on individualized projections developed by managers at various business units across FEI without any adjustments by FEI senior management to reflect the historical reality that it was rare for all of FEI’s business units to achieve their projected financial goals in any particular year. Therefore, the [Higher Projections] represented an upside case that would be dependent on substantially all individual business units of FEI performing at planned levels of performance, which was inconsistent with FEI’s historical experience, and as a result such [Higher Projections] were significantly less likely than the [Lower Projections] to reflect a reasonable estimate of the future performance of FEI on a standalone basis.

The Proxy warned that the Management Projections were “not fact and should not be relied upon as being necessarily indicative of actual future results,” and that “actual results may be materially better or worse than those contained in the Management Projections.”

Although the Proxy included both sets of projections, certain line items that were included in the Lower Projections table were omitted from the Higher Projections table. The omitted items include:

(a) Changes in net working capital;

(b) Capital expenditures; and

(c) Unlevered Free Cash Flow.

Plaintiff also alleges that the Fairness Opinion and analysis presented in the Proxy statement was flawed because it applied a discounted cash flow (DCF) analysis to the already-discounted Lower Projections, which, they allege, double-discounted the inherent value of FEI. On August 30, 2016, a majority of FEI’s shareholders voted overwhelmingly (35,414,825 for and 50,105 against) in favor of the Acquisition. 2

Plaintiff alleges that the Proxy statement was false and misleading, in violation of §14(a) of the 1934 Act and SEC Rule 14a-9, for four reasons: (1) it stated that the Board believed the Higher Projections were unrealistic, which was both subjectively and objectively false; (2) the Goldman Sachs discounted cash flow analysis was improperly double-discounted; (3) the Proxy misrepresented the Higher Projections by omitting certain line items that were included in the Lower Projections; and (4) the Proxy did not disclose the underlying data and key assumptions in the Goldman Sachs fairness analysis.

2 The Court takes judicial notice of FEI’s public filings with the SEC. See Dreiling v. Am. Exp. Co., 458 F.3d 942, 946 n.2 (9th Cir. 2006).

DISCUSSION

A. Section 14(a) Claims

Section 14(a) of the 1934 Act and SEC Rule 14a–9 “disallow the solicitation of a proxy by a statement that contains either (1) a false or misleading declaration of material fact, or (2) an omission of material fact that makes any portion of the statement misleading.” Desaigoudar v. Meyercord, 223 F.3d 1020, 1022 (9th Cir. 2000); see also 15 U.S.C. § 78n(a); 17 C.F.R. § 240.14a–9(a). “To state a claim under § 14(a) and Rule 14a–9, a plaintiff must establish that ‘(1) a proxy statement contained a material misrepresentation or omission which (2) caused the plaintiff injury and (3) that the proxy solicitation itself, rather than the particular defect in the solicitation materials, was an essential link in the accomplishment of the transaction.’” N.Y.C. Emps.’ Ret. Sys. v. Jobs, 593 F.3d 1018, 1022 (9th Cir. 2010) (quoting Tracinda Corp v. DaimlerChrysler AG, 502 F.3d 212, 228 (3d Cir. 2007)), overruled on other grounds by Lacey v. Maricopa County, 693 F.3d 896 (9th Cir. 2012) (en banc).

The Private Securities Litigation Reform Act (PSLRA) requires a plaintiff stating a claim under § 14(a) to: (1) “specify each statement alleged to have been misleading, the reason or reasons why the statement is misleading, and, if an allegation regarding the statement or omission is made on information and belief, ... all facts on which that belief is made,” 15 U.S.C. § 78u–4(b)(1)(B); (2) “state with particularity facts giving rise to a strong inference that the defendant acted with the required state of mind,” id. § 78u–4(b)(2)(A); and (3) establish that “the act or omission of the defendant alleged to violate this chapter caused the loss for which the plaintiff seeks to recover damages,” id. § 78u–4(b)(4), that is, plead “loss causation,” Stoneridge Inv. Partners v. Sci.–Atlanta, 552 U.S. 148, 165 (2008).

Defendants move to dismiss on the following alternative grounds (1) the PSLRA’s safe harbor provision shields the Board’s assessment of the two projections from liability under the SEA and even if it does not, Plaintiff has not established that the assessment was false or misleading or that Plaintiff knew that it was; (2) the SAC does not state a claim on the basis that the Goldman Sachs Fairness Opinion was false or misleading; (3) the SAC does not state a claim on the basis that the details omitted from the proxy were material; and (4) the SAC does not allege facts giving rise to a strong inference that Defendants acted with the required state of mind.

1. Board’s Assessment of Management Projections

a. Safe Harbor Provision

Claims under Section 14(a) are subject to the PSLRA’s safe harbor for “forward-looking statements.” 15 U.S.C. § 78u-5(c)(1) (safe harbor applies “in any private action arising under [the Securities Exchange Act] that is based on an untrue statement of a material fact or omission of a material fact necessary to make the statement not misleading.”); see also Fanni v. Northrop Grumman Corp., 23 F. App’x 782, 784 n.2 (9th Cir. 2001) (unpublished) (applying safe harbor to statements in a merger proxy in dismissing Section 14(a) claim); Bumgarner v. Williams Cos., 2016 WL 1717206, at *3-4 (N.D. Okla. Apr. 28, 2016) (same). A forward-looking statement is “any statement regarding (1) financial projections, (2) plans and objectives of management for future operations, (3) future economic performance, or (4) the assumptions underlying or related to any of these issues.” Police Ret. Sys. v. Intuitive Surgical, Inc., 759 F.3d 1051, 1058 (9th Cir. 2014) (citation omitted); see also 15 U.S.C. § 78u-5(i)(1). The PSLRA safe harbor provides that “a person . . . shall not be liable with respect to any forward-looking statement” that is either “(i) identified as a forward-looking statement, and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those in the forward-looking statement,” or (ii) not “made . . . with actual knowledge . . . that the statement was false or misleading.” 15 U.S.C. § 78u-5(c)(1); Intuitive Surgical, 759 F.3d at 1058.

Defendants argue that the Board’s opinion of the Management Projections in the Proxy is protected by the PSLRA safe harbor provision. Plaintiff responds that the Board’s expression of its opinion is not a forward-looking statement and the safe harbor provision therefore does not apply. Even if the provision does apply, Plaintiff argues, the statement is not protected because it was not accompanied by “sufficient cautionary language or risk disclosure” and it was made with the Board’s actual knowledge of its falsity.

Plaintiff first argues that the safe harbor provision applies only to “fraud by hindsight” suits, which this case is not. In a “fraud by hindsight” case, “a company makes a revenue projection (causing the stock price to rise), then later misses it (causing the stock price to fall),” and shareholders bring suit claiming that the earlier projection was false. The text of the statute does not support this narrow application. 15 U.S.C. § 78u-5(c)(1) (the safe harbor applies “in any private action arising under [the Securities Exchange Act] that is based on an untrue statement of a material fact or omission of a material fact necessary to make the statement not misleading.”) (emphasis added). Further, Plaintiff cites no case law giving the statement such a confined reading. Moreover, “fraud by hindsight” suits are not meaningfully different from the case at hand. In both cases, a company makes a purportedly inaccurate forward-looking statement that induces plaintiffs to act to their detriment. Here, Plaintiff claims that the forward-looking statement induced shareholders to sell at a lower price than was wise, given the actual value of the company. This scenario is not qualitatively different from a situation in which a company makes a forward-looking statement that induces shareholders to buy stock at a higher price than the actual performance of the company may merit. The safe harbor provision of 15 U.S.C. § 78u-5 therefore applies to the Board’s expression of its belief that the Higher Projections were a less likely outcome than the Lower Projections, to the extent that such an expression was a forwardlooking statement.

i. Forward-looking Statement

The Higher and Lower Projections are quintessential forward-looking statements, as financial projections and statements of future economic performance. The Board’s statement in the Proxy that “the [Higher] Projections were significantly less likely than the [Lower] Projections to reflect a reasonable estimate of the future performance of FEI on a standalone basis,” also is a forward-looking statement as an “assumption underlying or related to” FEI’s future economic performance. See Intuitive Surgical, Inc., 759 F.3d at 1059. The safe harbor provision does not protect companies and their officials from suit when they “make a materially false or misleading statement about current or past facts, and combine that statement with a forward-looking statement” In re Quality Sys., Inc. Sec. Litig., 865 F.3d 1130, 1142 (9th Cir. 2017) (emphasis added). When a statement mixes forward-looking statements with statements about present or historical fact, only the statements about present or historical fact are not protected by the safe harbor. Id.

In Quality Systems, the Ninth Circuit considered examples of mixed statement cases from other circuits to determine which portions of those statements are protected and which are not. In In Re Stone Wester, Inc., Securities Litigation, for example, the First Circuit held that the safe harbor provision did not protect a company’s statement that it “has on hand and has access to sufficient sources of funds to meet its anticipated operating, dividend and capital expenditure needs,” because the statement reflected the company’s current access to cash. 414 F.3d 187, 211- 213 (1st Cir. 2005). “The claim was not that the [c]ompany was understating its future cash needs,” but that it misrepresented an allegedly dire current cash shortage. Id. at 213. In Makor Issues & Rights, Ltd. v. Tellabs, Inc.(Tellabs II), the Seventh Circuit characterized a company’s statement that sales were “still going strong” as conveying “both that the current sales were strong and that they would continue to be so, at least for a time.” 513 F.3d 702, 705 (7th Cir. 2008). The Seventh Circuit then held that the predictive element of the phrase did not prevent the “the statement’s representation concerning current sales” from being subject to suit. Id

Recently, a magistrate judge in this district recommended that any statements in a proxy about “the conditions at the time the [b]oard was formulating an opinion on the merger” not be considered forward-looking. NECA-IBEW Pension Tr. Fund v. Precision Cast Parts Corp., 2017 WL 4453561, at *11 (D. Or. Oct. 3, 2017). 3 In that case, which also involved two sets of projections, the board’s statements justifying its reliance on one projection over the other were considered non-forward-looking statements, including its statement that one set of projections “reflected management’s most up-to-date and accurate forecasts.” Id. Because that statement could be proven demonstrably true or false at the time it was made, it was not a forward-looking statement.

As shown in the cases described above, the safe harbor provision does not protect the statements in the Proxy underlying the Board’s assessment about the Management Projections. Such unprotected statements of present or historical fact include the Board’s description of how the Management Projections were developed, the statement regarding the “historical reality that it was rare for all of FEI’s business units to achieve their projected financial goals in any particular year,” and the statement that the Higher Projections were “dependent on substantially all individual business units of FEI performing at planned levels of performance.” Plaintiff does not, however, allege that any of these statements of present or historical fact are false or misleading. Rather, Plaintiff challenges the Board’s statement of its actual belief in its assessment that the Lower Projections “were more likely to reflect the future business performance of FEI on a standalone basis than would the Higher Projections.” Id. Plaintiff attempts to distinguish between the Board’s assessment of the Management Projections, which is a forward-looking statement, and the Board’s expression of its belief in the reasonableness of that assessment. The Board’s statement of its belief, Plaintiff argues, is not forward-looking because it expresses the “present fact regarding defendants’ present belief.” In other words, Plaintiff contends that the Board did not really believe what it said it believed.

3 At the time of this order, the magistrate’s Findings and Recommendation had not yet been adopted by a district judge.

To take the view that an expression of “present belief” in a forward-looking statement is a “present fact”—and therefore not itself a forward-looking statement—would work an end-run around the PSLRA’s safe harbor provision. Expressing confidence or lack thereof in a given projection is not different from making a projection. Every statement of a future projection carries at least the implicit assertion that the speaker or writer of that statement believes it. See Grobler v. Neovasc Inc., 2016 WL 6897760, at *5 (D. Mass. Nov. 22, 2016) (“[v]irtually every statement about a future event could be said to imply a statement of present belief”). Where a defendant makes a false or misleading statement about the facts supporting a projection to justify its belief in or preference for a forward-looking statement, the safe harbor does not protect those statements. But a defendant’s statement of its belief in or preference for a given projection is itself a forward-looking statement that is protected. The Board’s assessment that the Higher Projections were significantly less likely to reflect a reasonable estimate of FEI’s future performance was therefore a forward-looking statement entitled to protection.

ii. Sufficient cautionary language or risk disclosure

A forward-looking statement cannot be the basis of liability when it is identified as such “and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those in the forward-looking statement.” 15 U.S.C. § 78u-5(c)(1). To justify dismissal at the pleadings stage, the cautionary language or risk disclosure must be such “that reasonable minds could not disagree that the challenged statements were not misleading.” Livid Holdings Ltd. v. Salomon Smith Barney, Inc., 416 F.3d 940, 947 (9th Cir. 2005). This stringent standard is met here.

Defendants point to the Management Projections portion of the Proxy. That section contained a summary of both projections, identified the key assumptions underlying both, and the Board’s opinion that the Higher Projection was a less likely outcome than the Lower Projection. The section also said that the “Management Projections are forward-looking statements,” and included a lengthy cautionary statement. That cautionary statement identified the factors that could result in “materially better or worse” actual results, including the “accuracy of certain accounting assumptions, changes in actual or projected cash flows, competitive pressures and changes in tax laws.” The Management Projections portion of the Proxy included the following bolded admonition: “In light of the foregoing factors and the uncertainties inherent in the Management Projections, shareholders are cautioned not to place undue, if any, reliance on the projections included in this proxy statement.” The Ninth Circuit has found far less to be sufficient. See Intuitive Surgical, 759 F.3d at 1059-60 (finding sufficient cautionary language in a disclaimer that “[a]ctual results may differ materially from those expressed or implied, as a result of certain risks and uncertainties. These risks and uncertainties are described in detail in the company’s [SEC] filings. Prospective investors are cautioned not to place undue reliance on such forward-looking statements.”) (alteration in original); see also In re Cutera Sec. Litig., 610 F.3d 1103, 1112 (9th Cir. 2010)(finding sufficient cautionary language in a verbal disclaimer on a teleconference that “factors like [the company’s] ‘ability to continue increasing sales performance worldwide’ could cause variance in the results.”).

Plaintiff argues, however, that there was no cautionary language warning stockholders that the opinion of the projections that Defendants expressed was different from the opinion that they actually held. Plaintiff again attempts to distinguish between Defendants’ assessment of the two projections and their expression of belief in that assessment. For the reasons already stated, this distinction is legally irrelevant. The Board’s assessment of the two projections was the material statement. Because that assessment was properly identified as a forward-looking statement and accompanied by cautionary language, it is protected by the safe harbor provision.

iii. Actual knowledge of falsity

Defendants also argue that Plaintiff did not establish that the Management Projection in the Proxy was not “made . . . with actual knowledge . . . that the statement was false or misleading.” 15 U.S.C. § 78u-5(c)(1); Intuitive Surgical, 759 F.3d at 1058. But “if a forwardlooking statement is identified as such and accompanied by meaningful cautionary statements, then the state of mind of the individual making the statement is irrelevant, and the statement is not actionable regardless of the plaintiff's showing of scienter.” In re Cutera Sec. Litig., 610 F.3d 1103, 1112 (9th Cir. 2010). Because the the Management Assessment is a forward-looking statement accompanied by sufficient cautionary language, the Court need not decide whether Plaintiff has sufficiently plead scienter.

b. Material Misstatement or Omission

If the PSLRA safe harbor provision were held not to apply to the Management Assessment, Plaintiff must still (1) “specify each statement alleged to have been misleading, the reason or reasons why the statement is misleading, and, if an allegation regarding the statement or omission is made on information and belief, ... all facts on which that belief is made,” 15 U.S.C. § 78u–4(b)(1)(B), and (2) “state with particularity facts giving rise to a strong inference that the defendant acted with the required state of mind,” id. § 78u–4(b)(2)(A).

Defendants do not appear to argue that the Board’s opinion of the Management Projections in the Proxy was immaterial. They argue, rather, that Plaintiff has not sufficiently alleged that that opinion was false or misleading. The Board’s assessment that the Higher Projections were likely less realistic than the Lower Projections was a statement of opinion or belief. Statements of opinion, reasons, or belief in a Proxy may be actionable as material misstatements, but “proof of mere disbelief or belief undisclosed [does] not suffice for liability under § 14(a).” Va. Bankshares, Inc. v. Sandberg, 501 U.S. 1083, 1096 (1991) (holding that a proxy's statement that $42 per share was a “high value” and a “fair price” for minority stock could be materially misleading). Plaintiffs can recover for a material misstatement of opinion “only if the complaint alleges with particularity that the statements were both objectively and subjectively false or misleading” Rubke v. Capitol Bancorp Ltd, 551 F.3d 1156, 1162 (9th Cir. 2009). Thus, Plaintiff must allege with particularity not only that the Higher Projections actually more accurately represented FEI’s prospects than the Lower Projections, but also that Defendants believed that the Higher Projections more accurately represented FEI’s long-term prospects.

i. Objective Falsity

A statement of opinion about future performance may be found to be objectively false where it is “seriously undermined by undisclosed facts or unreasonable assumptions or that does not follow generally accepted accounting principles.” In re Hot Topic, Inc. Securities Litigation, 2014 WL 7499375 at *6 (C.D. California May 2, 2014) (citing Knollenberg v. Harmonic, 152 F. App’x 674, 678 (9th Cir. 2005)). The facts of this case somewhat resemble those of Hot Topic, in which a district court found that the plaintiff had sufficiently stated that the board’s opinion statement favoring a less optimistic set of projections in a merger proxy was both objectively and subjectively false. In that case, the defendant company developed a set of long-range projections (“LRP Projections”) in early 2012. Id. at *2. Nearly one year later, in February 2013, a buyer made an offer to acquire the company. Id. The company rejected the initial offer, but accepted a slightly higher offer one month later, in March 2013. Id. In that one-month span, the plaintiffs alleged, the company’s board had developed a set of revised projections that significantly moderated downward the company’s anticipated growth and profits. Id. The company directed its financial advisor to rely on the lower, revised projections in developing its fairness analysis and claimed in the proxy statement that the revised projections “better reflect[ed] what management believed the Company would be able to achieve during the next five years compared to the LRP Projections.” Id. at *3.

The court in Hot Topic found that the board’s stated opinion was based on “flawed and inaccurate assumptions,” in large part because the revised opinions directly conflicted with specific public statements made by the company. Id. at *6. For example, the revised projections moderated downward growth in a specific brand, despite the company having frequently praised that brand’s growth. Id. The revised projections also assumed a slower buildout of stores for specific brands, despite the company’s stated goals of opening more of these stores. Id. Further, the revised projections moderated downward gross revenue growth, despite strong revenue growth between 2010 and 2012 (the two years immediately preceding the merger). Id. Finally, the company had presented only the LRP Projections to the buyer, suggesting that those projections were sufficiently accurate for the buyer to evaluate the company’s future prospects. Id. The court found that, based on these facts, it was at least plausible that the defendants had changed the projections to result in a less accurate forecast. Id.

Plaintiff relies on Hot Topic to argue that here, too, there is sufficient evidence that the Board’s statement about the Management Projections was objectively false. There are certain similarities between the two cases. In both cases, the defendant companies developed two sets of projections and included both in merger proxy statements, but directed their financial advisors to develop fairness opinions based only on the less optimistic projection. As in Hot Topic, Plaintiff alleges that the Higher Projections were provided to Thermo in the course of merger discussions, and Defendants otherwise routinely used and relied upon the Higher Projections before the merger, indicating that Defendants believed those projections were an accurate reflection of their future prospects. 4 Also, as in Hot Topic, the Board’s ultimate reliance on the less optimistic projections appears, at least on its face, inconsistent with FEI’s positive quarterly reports in 2015.

Beyond these facial similarities, however, the facts stated by Plaintiff in this case are not as compelling as those stated in Hot Topic. In this case, the Lower Projections and the Higher Projections, developed during the same internal review process in Fall 2015, projected identical performance by FEI through the year 2016. Only in the year 2017 do the two projections begin to diverge. Because the two sets of projections were identical for the year of 2016, FEI’s quarterly financial reports, whether positive or negative in outlook, are consistent with both sets of projections. Further, FEI’s public statement following the first quarter of 2016, anticipated fullyear revenue for 2016 to “be in the range of $1.02 billion to $1.05 billion, and EBITDA in the range of $235 million.” These anticipated ranges were lower than both Management Projections for 2016, which anticipated approximately $1.096 billion in Non-GAAP revenue and $271 million EBITDA for 2016. Moreover, whereas the plaintiff in Hot Topic alleged that the Revised Projections conflicted with “every public statement” made over eight quarters immediately preceding the merger (“1Q2011 through 4Q2012”), id. at *2, Plaintiff here alleges that Lower Projections were inconsistent with only the last quarter of 2015 and the first quarter of 2016. As has been shown, these inconsistencies themselves are not particularly compelling. Further, Plaintiff notes that FEI had rebounded from “a temporary industry downturn,” which supports an inference that public statements over a period of time as long as that cited in Hot Topic may have been most consistent with the more modest projections.

4 Defendants argue, citing the Proxy, that the Board relied primarily on the Lower Projections, while also considering the Higher Projections when reviewing Thermo’s offers. The Proxy, incorporated by reference in Plaintiff’s Complaint, supports this view. The Court notes, however, that in preparing the Proxy, the Board had an incentive to avoid future litigation and justify its reliance on the Lower Projections. Construing all inferences in favor of the Plaintiff at this stage in the litigation, the Court accepts Plaintiff’s statement of facts.

Finally, the primary assumption that the Board articulated in the Proxy for finding the Lower Projections to be more realistic is that the Higher Projections were “inconsistent with FEI’s historical experience,” because “it was rare for all of FEI’s business units to achieve their projected financial goals in any particular year,” as the Higher Projections presumed. ECF 47-2 at 51. Plaintiff’s SAC, in fact, alleges that the company had recently experienced an industrywide “downturn.” Thus, the assumption that the Board’s opinion was at least partially based upon—that certain sectors would miss at least some of their goals, as they had historically done—is not unreasonable.

ii. Subjective Falsity

Under the PSLRA, Plaintiff must “state with particularity facts giving rise to a strong inference that” Defendants made the alleged misrepresentations with the required state of mind. In this case, that means Plaintiff must allege particular facts demonstrating Defendants’ actual disbelief that the Lower Projections more accurately reflected FEI’s future performance as a standalone company. 15 U.S.C. § 78u-4(b)(2)(A); see also Hot Topic at *7.

In Hot Topic, the court found that the plaintiffs had sufficiently stated subjective falsity for two of the individual defendants in alleging that those defendants “knew as early as November 2012 that the LRP Projections . . . would have to be revised downward and moderated in order for any eventual merger to appear fair from a financial perspective to Hot Topic’s shareholders.” Id. at *7 (quoting complaint). Here, Plaintiff makes a nearly identical allegation in its SAC:

The Board knew that relying on the Lower Projections would lower Goldman Sachs’ calculation of FEI’s intrinsic value and was the only way to make Thermo Fisher’s final offer, expected to be only slightly above the current $105.00 per share offer, appear to be financially fair in comparison to the Company’s true value.

Although the alleged fact that Defendants knew that more pessimistic projections would be necessary to make the merger appear fair is relevant to the inquiry, this allegation alone is insufficient to give rise to a “strong inference” of actual disbelief in the likelihood of the Lower Projections.

In Hot Topic, the court looked to other facts surrounding the board’s decision-making process to evaluate other individual defendants’ subjective belief. The court found relevant that other board members used the LRP Projections “throughout 2012 without any doubt as to the appropriateness of the assumptions underlying the projections.” Id. at *7. The Hot Topic complaint also detailed a board meeting shortly before the buyer made its first offer in which the LRP projections were discussed with no reference to their inadequacy or inaccuracy. Id. Taken together, the court held that these allegations sufficiently stated that the individual defendants knew that the opinion given in the proxy about the two sets of projections was misleading or false.

Here, Plaintiff alleges that Defendants “continued to use and rely on [the Higher Projections], including in conjunction with FEI’s acquisition of DCG Systems, Inc. on December, 10, 2015.” FEI also “adjusted the projections to include the financial forecast used by FEI in conjunction with the acquisition. 5 Plaintiff also alleges that there were other board meetings in which Defendants do not take the position that the Higher Projections were inaccurate, but does not specifically allege that any projections were discussed at those meetings. Plaintiff specifically alleges that FEI’s management provided Thermo with the Higher Projections while attempting to “convey the intrinsic value of FEI” late in the acquisition negotiations. These facts tend to support an inference that Defendants believed the Higher Projections to be reliable.

There are, however, two important differences that undermine an inference of subjective falsity in this case. First, the Lower Projections were developed before a merger with Thermo was even contemplated. In Hot Topic, the revised projections were developed on the eve of a merger, after at least one offer from the eventual buyer had been rejected. 2014 WL 7499375 at *2. At that point, the company had relied on the LRP Projections for nearly a year, giving rise to a strong inference of bad faith when the board suddenly discarded them for the more pessimistic projections. Similarly, in Azar v. Blount, this Court denied a motion to dismiss in a securities litigation case where the defendant company had developed a new, more pessimistic set of projections on a questionable schedule. 2017 WL 1055966 (D. Or. Mar. 20, 2017). In that case, the defendant company received an offer from a buyer in August, developed an optimistic set of projections in September, engaged in acquisition negotiations with the buyer through October, developed more pessimistic projections in November, and relied on those new lower projections to justify a merger in December. Id. at *2-3. The defendant company then included only the lower November projections in its merger proxy statement, despite the fact that the more optimistic projections had been created only two months earlier, and there appeared to be no justification for moderating them downward. Id. at *3.

5 The Proxy notes that both sets of Management Projections were updated after the acquisition.

In the pending case, however, FEI had been working with two sets of projections since before the merger opportunity ever arose. The Lower Projections were developed in the “ordinary course of business,” as part of the same review process as the Higher Projections. Both sets were created several months before Thermo engaged FEI in acquisition discussions. The timing of the development of the two sets of projections in this case thus does not give rise to the same strong inference of bad faith and improper motive as the timing in Hot Topic and Azar.

Second, Plaintiff has not alleged a conflict of interest to the same degree as was alleged in Hot Topic or Azar. In Hot Topic, the Defendant CEO kept her position as CEO and “chose to participate in Hot Topic’s future upside as a Company rather than take the [merger sale price], indicating that she thought the [m]erger consideration offered to Hot Topic’s public shareholders was not fair or adequate,” Id. at *3 (quoting complaint). In Azar, the defendant CEO and defendant COO also retained their positions, giving them “an interest in the merger separate from those of other [company] shareholders.” Azar, 2017 WL 1055966 at *2. Moreover, although the CEO and COO in Azar were shielded off from the special committee overseeing merger negotiations due to their conflict, those two defendants were alleged to have spurred the company’s financial advisors to request that the board develop the more pessimistic projections. Id. at *3. The plaintiff in that case stated extensive facts giving rise to the inference that “improperly-motivated management defendants worked with financial advisors to create more pessimistic financial projections to present to shareholders to justify a merger.” Id. at *8.

In this case, however, Plaintiff does not allege that any Defendant was on both sides of the deal. Instead, Plaintiff alleges that the Individual Defendants were conflicted because of the benefits that they reaped as the result of a successful merger, including the liquidation of their illiquid stock and other cash bonuses. These interests of the Individual Defendants in the merger were fully disclosed, however, in the Proxy statement. Most importantly, Plaintiff alleges that Defendants were exclusively on the sell side. Although they were poised to garner substantial bonuses as the result of the merger, the Individual Defendants, unlike those in Hot Topic and Azar, would not benefit to the detriment of stockholders were the stock to be sold at less than its fair value. Thus, these facts do not give rise to the same strong inference that the recommendation to rely on the more pessimistic projections was in bad faith and therefore knowingly false.

2. Remaining Claims

In addition to the statements discussed above, Defendant alleges that the Fairness Opinion issued by Godman Sachs was a material misrepresentation and that the Proxy contained material omissions by not including certain accounting data about the Higher Projections in the Proxy.

a. The Fairness Opinion

Plaintiff alleges that the Fairness Opinion was false or misleading because the DCF analysis on which that opinion relied effectively “double discounted” the value of FEI by “aggressively discounting” the already-discounted Lower Projections “once more for risk.” Defendants argue that the Fairness Opinion in the Proxy was neither false nor misleading, and that Plaintiff’s claim misunderstands the nature of a discounted cash flow analysis. Defendants do not contest the materiality of the Fairness Opinion. Defendants argue that the discount rates are applied to “convert expected future cash flows, derived from management’s projections, into present-day dollars in order to estimate a current value for the company.” Plaintiff responds that the discount rate of “9.5% to 11.5%” that Goldman Sachs applied, which reflected “estimates of [FEI’s] weighted average cost of capital,” was improperly high because the Lower Projections already accounted for risk. Plaintiff adds that the question is one for the jury.

Defendants correctly describe the role of DCF analysis in a proxy statement. The discount rates that financial analysts apply do not reflect risk, but are used to determine the present value of a business by calculating “the future benefits discounted back to a present value at some appropriate discount (capitalization) rate.” In re Radiology Assoc., Inc. Litig., 611 A.2d 485, 490 (Del. Ch. 1991). Plaintiff’s theory that the value of the company was “doublediscounted” for risk, therefore, cannot sustain a claim that the Fairness Opinion was a material misstatement.

Plaintiff presents a new theory in its response, arguing that the discount rate applied by Goldman Sachs was improperly high. The discount rate in a discounted cash flow analysis reflects a financial analyst’s judgment, and disagreement over the rate does not form the basis of a § 14(a) claim. See Ridler v. Hutchinson Tech. Inc., 216 F. Supp. 3d 982, 990 (D. Minn. 2016)(“P]laintiffs point to no objective flaw in [the financial analyst]’s analysis, but only to a disagreement over subjective valuation methodology. Plaintiffs have also failed to sufficiently plead that [the financial analyst] rendered the opinion in bad faith.”). The analysis that Goldman Sachs undertook in forming the Fairness Opinion was fully disclosed in the Proxy. If Goldman Sachs did apply a higher discount rate than is consistent with industry standards, any “shoddy” analysis was available for shareholders to observe and consider in their decision. See In re Netsmart Techs., Inc. Shareholders Litig., 924 A.2d 171, 203 (Del. Ch. 2007), judgment entered sub nom. In re Netsmart Techs., Inc. Shareholders Litig. (Del. Ch. Mar. 19, 2007) (“Investors can come up with their own estimates of discount rates.”). The result of the analysis may be false or misleading if underlying assumptions or key inputs are omitted or misrepresented, but that is not the case here. Because, as described above, Plaintiff has not sufficiently alleged that the inputs and assumptions relied upon for the fairness analysis—the Lower Projections—were inaccurate or misleading, Plaintiff has also failed to sufficiently allege that the Fairness Opinion based upon them was materially misleading.

b. Omitted Accounting Details

Plaintiff argues that, although the Proxy disclosed both sets of Management Projections, it was nevertheless materially misleading because the summary of the Higher Projections omitted certain accounting details that were included in the Lower Projections. Those details include:

(a) Changes in net working capital;

(b) Capital expenditures; and

(c) Unlevered Free Cash Flow

Defendants argue that the omission of these details is not material. The Court notes that unlevered free cash flow is derived by adding or subtracting depreciation and amortization, changes in net working capital, and capital expenditures from the projected net income. Net income and depreciation and amortization were included for both sets of projections. Because unlevered free cash flow is the result of simple arithmetic, only the omission of the inputs necessary to reach that result—changes in net working capital and capital expenditures—is potentially material.

The Supreme Court held in TSC Industries, Inc. v. Northway, Inc. that, for purposes of a § 14(a) claim, “[a]n omitted fact is material if there is a substantial likelihood that a reasonable shareholder would consider it important in deciding how to vote.” 426 U.S. 438, 449 (1976). Plaintiffs must allege that there is a “substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.” Id.

Plaintiff relies on this Court’s opinion in Azar to emphasize “the importance (and, hence, materiality) of financial projections to shareholders’ decision-making,” 2017 WL 1055966 at *6, when shareholders must decide whether to accept the merger consideration or to continue as shareholders of the corporation. The omission at issue in Azar, however, involved an entire set of (allegedly more accurate) financial projections. Here, as in Hot Topic, Defendants disclosed a summary of both sets of Management Projections, including the following twelve line items for the Higher Projections:

Defendants omitted only what the court in Hot Topic described as “particularized accounting details” from the Higher Projections. 2014 WL 7499375 at *9. The court in Hot Topic noted that requiring such details would “threaten to ‘bury the shareholders in an avalanche of trivial information.’” Id. (quoting TSC Indus. 426 U.S. at 449). Though it is true, as Plaintiff argues, that incomplete statements may be “half-truths” and therefore misleading under § 14(a) “by virtue of what they omit to disclose,” In re Vivendi, S.A. Sec. Litig., 838 F.3d 223, 239-40 (2d Cir. 2016), those omissions must nevertheless of the kind that would influence a shareholder’s vote.

Here, Plaintiff makes only conclusory allegations that the omitted details are material, claiming that they are necessary for shareholders to make an accurate comparison between the Lower and Higher Projections. Plaintiff alleges no facts, however, that would explain why the information that shareholders did have access to was insufficient to provide a fair comparison between the Management Projections in the absence of the omitted facts. The most valuable information in financial projections is the management’s view of the company’s future prospects. As the Delaware Court of Chancery noted, “[i]nvestors can come up with their own estimates of discount rates or . . . market multiples. What they cannot hope to do is replicate management's inside view of the company's prospects.” Netsmart, 924 A.2d at 203. Here, Defendants included the management’s inside view of the company’s prospects for both sets of projections, and explained in general terms why the less optimistic projections were more realistic, and more appropriate for the Fairness Opinion. Plaintiff alleges no facts suggesting that the inclusion of the additional accounting details for the Higher Projections would have “significantly altered the ‘total mix’ of information available” to investors. Plaintiff has not, therefore, sufficiently alleged that these omissions are material and has thus failed to state a claim under § 14(a).

B. Section 20(a)

Plaintiff’s claim under § 20(a) of the 1934 Act is dependent on Plaintiff’s ability to plead a primary violation of § 14(a) against Defendants. 15 U.S.C. § 78t(a). Because the Court finds that Plaintiff has not adequately pleaded a § 14(a) claim against Defendants, it finds that Plaintiff has also failed to plead a § 20(a) claim against all Defendants.

CONCLUSION

For the foregoing reasons, Defendant FEI and Individual Defendants’ motion to dismiss (ECF 65) and Defendant Thermo’s motion to dismiss (ECF 64) are GRANTED. Plaintiff’s Second Amended Complaint (ECF 61) is dismissed. If Plaintiffs believe that they can cure the deficiencies identified in this Opinion and Order, Plaintiffs may replead within 14 days.

IT IS SO ORDERED. DATED this 25th day of January, 2018.

/s/ Michael H. Simon Michael H. Simon

United States District Judge