Understanding RIAs In Valuation

Business continuity has become a hot topic in the financial advisory industry. This is partially attributable to the generation gap. The Baby Boomers who have greatly expanded the landscape of the financial advisory industry are now contemplating retirement or selling their ownership interests. The Industry has been booming for 20 years, but is now challenged by technology and generational mindsets. When developing your Firm’s continuity plan, how have you decided how to ensure that your buy-out is attainable and fair? To avoid a problematic outcome, you need to have a good understanding of the business valuation process and review your continuity plans regularly.

Understanding RIAs

The title, Registered Investment Advisor (“RIA”), was first defined in the Investment Advisers Act of 1940. An RIA is a registered firm or individual who is engaged by clients to provide investment advice. RIAs are required to register with regulatory agencies like the Security and Exchange Commission and have fiduciary mandate to act in the best interest of their clients. Although RIAs have been personal relationships with their clients. Firms do not require heavy capital investment and modern technology has allowed for flexibility in managing client relationships. However, aside from the larger firms, there is not a typical small firm. Each firm sets its own culture and resulting value cannot be determined by a one size fits all formula.

Valuation Demands

Just like all other business owners, events arise when RIAs seek to understand the value of their equity. And though the Partners of an RIA may be well-versed in the financial analysis, they may be required to reach out to a qualified independent business appraiser for any of the following reasons:

- Sale of Practice

- Resignation, retirement, or buyout of a Partner

- Reverse Merger or Squeeze Out

- Marital Dissolution of a Partner

- Drafting or Executing a Buy / Sell Agreement

- Creating an Employee Stock Ownership Plan

- Gifting to Beneficiaries

- Bankruptcy

- Death of Partner

Often these smaller to mid-sized firms have dormant Buy/Sells. Meaning, they may have a Buy/Sell in place but have not had an independent appraisal to determine a baseline value. Valuations for growing RIAs are often performed annually. Considering price volatility of the securities markets, the Enterprise Value of individual RIAs rarely remain static.

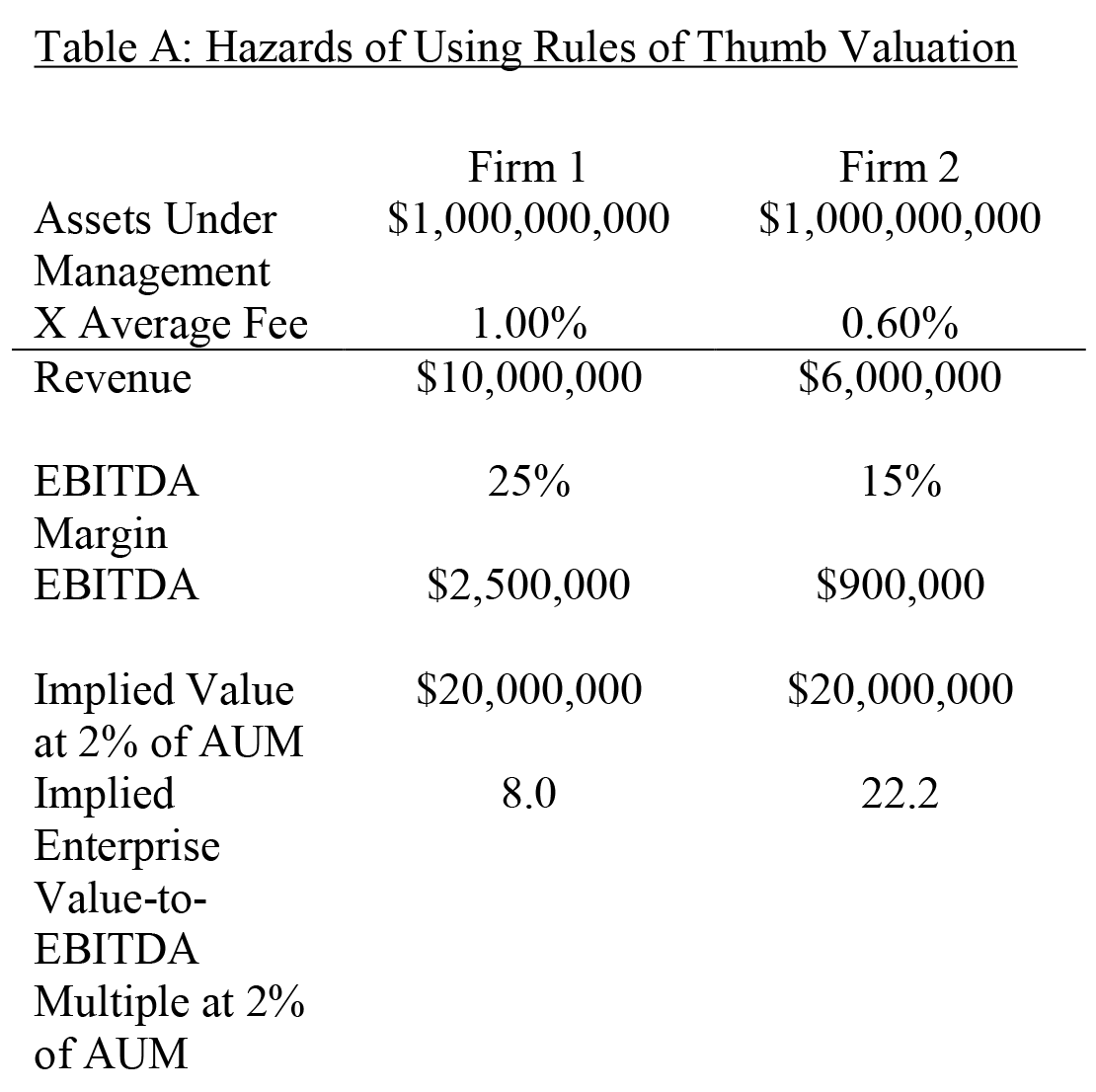

One Rule of Thumb, for example, is that the purchase price of an RIA is 2% of AUM. This old outdated Rule of Thumb is highly flawed due to the wide dispersion of fee range, operating margin and market volatility.

Table A demonstrates the high dispersion of EBITDA multiples based on a static Rule of Thumb or Predefined Valuation Formula. Based on above, the lower margin Firm 2 would garner a higher EBITDA Multiple based on a Rule of Thumb 2% of AUM.

Additional Considerations: The Purpose of Appraisal and Standard of Value

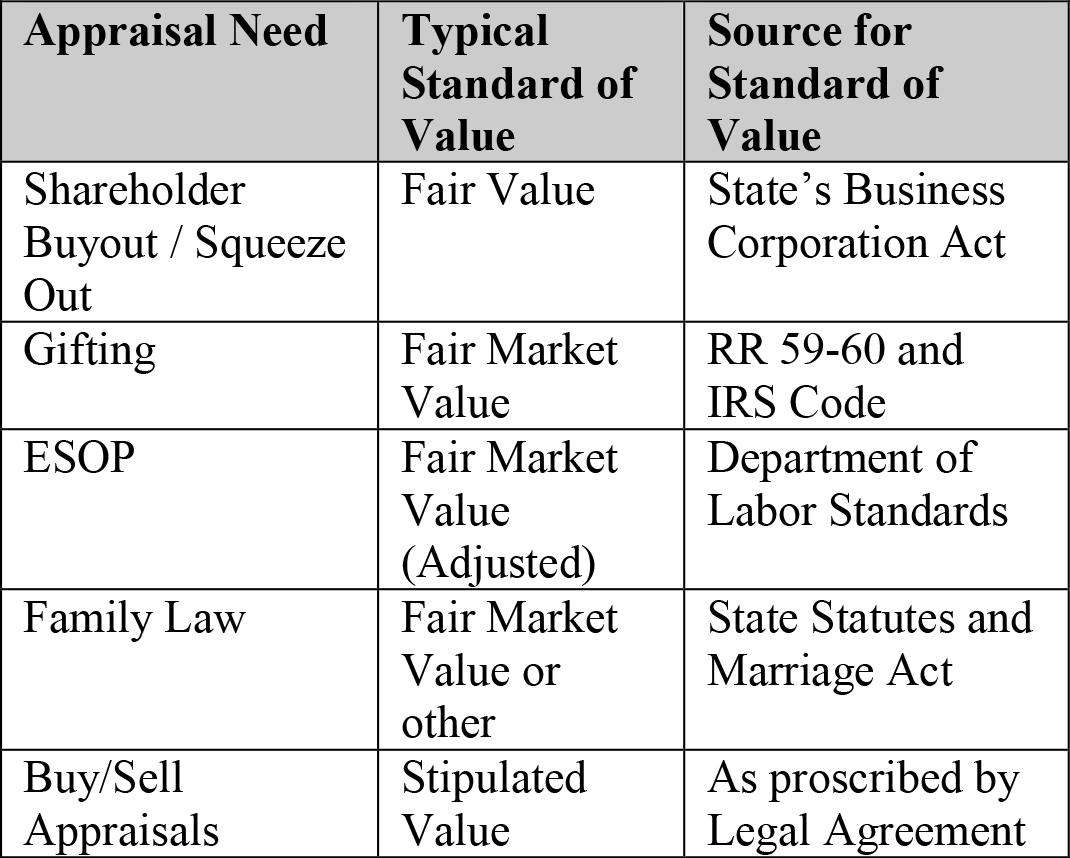

As appraisers, we begin each engagement by determining what we are valuing. We must come to agreement with the Client to whether they are seeking the value of the Business’ assets, equity, goodwill, or a specific owner’s interest. We also determine the date of valuation, the purpose of the engagement and the standard of value.

Standard of Value. For example, most of our engagements fall under the standard of Fair Market Value. This Standard is based on IRS Revenue Ruling 59-60 and other promulgations that declare the price to be based on a Willing Buyer / Willing Seller, with the Willing Buyer having all reasonable facts and the Willing Seller not being under duress. The Fair Market Value Standard is utilized in tax engagements and many states matrimonial statutes. Fair Market Value gives rise to discounts, most notably, discounts for lack of control and lack of marketability. The following table shows common needs for appraisal and the corresponding Standard of Value:

Another significant Standard of Value is Fair Value and is often defined within each state’s business corporation act, usually precludes or limits discounts, even for a minority interest.

Final Thoughts

As the needs for frequent business valuations arises to RIAs, equity holders will need to familiarize themselves with the nuances of the business valuation process. Additionally, as business continuity planning becomes a hot button issue for recognized for over 70 years, the professional title has gained popularity in the last two decades because retail customers enjoyed the relational intimacy and fee arrangements that are comparable to those provided by the larger financial investment firms.1 According to the Investment Advisor Association 2014 annual profile, 700,000 individuals are employed at 10,895 firms, with $61.7 trillion in registered Regulatory Assets Under Management (“RAUM”). The industry’s customer concentration is unique. For instance, more than half of the RAUM is managed by 112 firms which equates to 1% of all registered advisors. The top 112 RIAs reported $100 billion or more in RAUM. This is contrasted by the fact that 71.5% of all advisors manage have less than $1 billion in RAUM. As reported in 2014, a typical RIA has 9 employees, $331.2 million in RAUM, and 100 clients.

Based on this analysis, most advisors are with smaller to mid-sized firms whose primary driver of value is strong Best practices in multi-partner firms should include annual appraisal, however, some firms require independent appraisals biannually or quarterly.

False Assurance: Rules of Thumb and Predefined Valuation Formulas

Many RIAs dedicate too little time planning their ownership documents. This might include crafting a boilerplate Buy/Sell Agreement. However, Buy/Sell Agreements control the transition process based on the occurrence of certain possible future inflection points (Death of a Partner, Redemption of a Partner’s Interest, Disassociation of a Partner, Etc.). Utilizing Rules of Thumb or Predefined Valuation Formulas are convenient when drafting your buy/sell agreement. These formulas provide a static, simplistic methods for determining potentially large payouts in the future. However, when a Partner is bought out at an unknown later date, the RIA may have serious concerns in managing the potentially large unexpected cash outflow. Neither a Rules of Thumb nor Predefined Valuation Formulas consider important factors to the specific interest in the RIA. Growth rates, client demographics, market volatility, gross margin and fee schedules relative to their peers, ownership and corporate structure are not addressed by the utilization of Rules of Thumb or Predefined Valuation Formulas

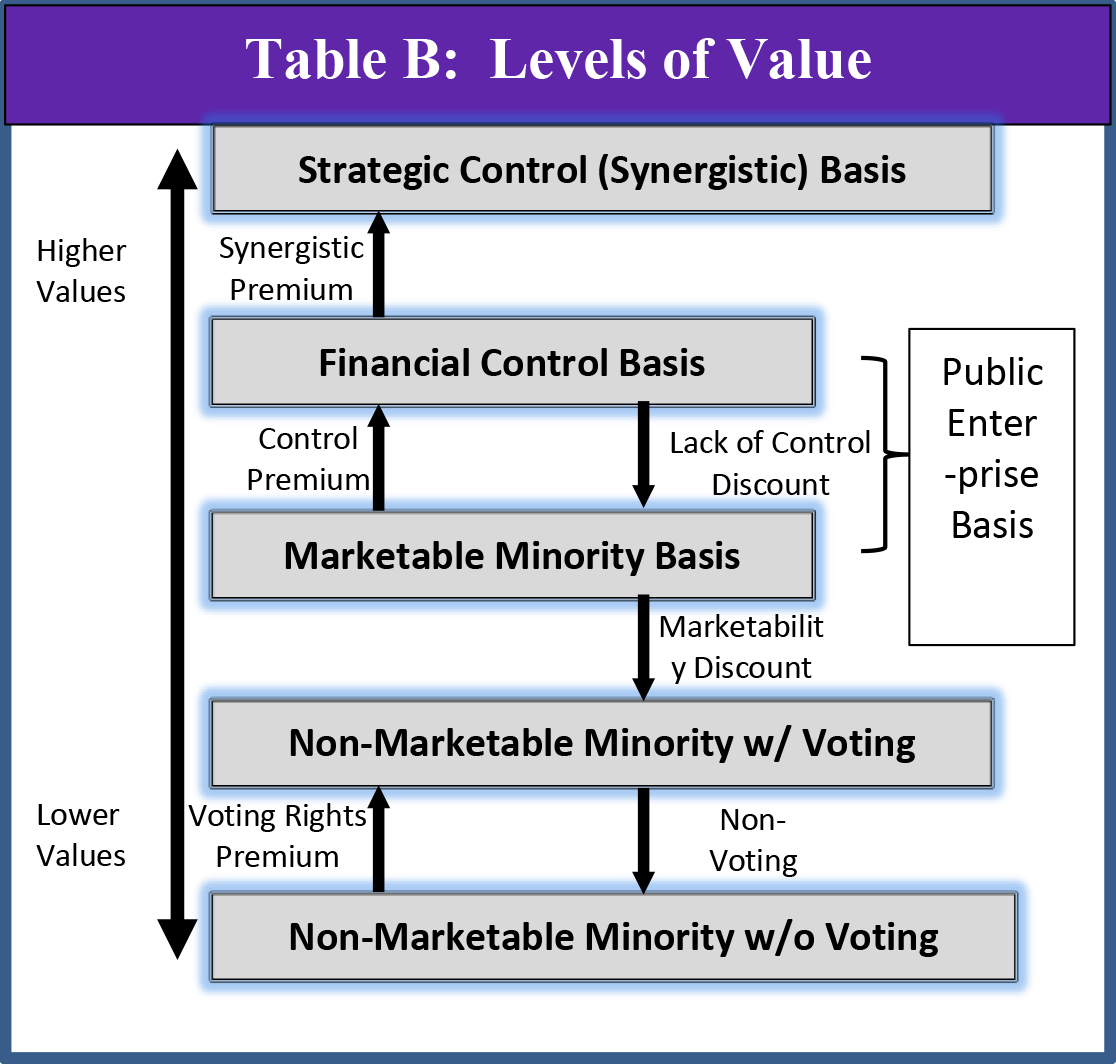

The appraisal of the Partner’s Interest is materially different than the appraisal of the RIA in toto. All things equal and unless stipulated in ownership documents, the value of a minority interest in an RIA is lower than the pro-rata value of a 100% interest in the RIA. The difference in values is partially explained by the inherent lack of control of a minority owner. Although both minority and controlling interests are considered non-marketable, market forces are stronger on a minority positions. This results in a higher Discount for Lack of Marketability.

As demonstrated in Table B in the following page, the difference between a small minority interest and a 100% interest in the RIA is material. A small minority interest, under certain standards of value will be materially discounted relative to the valuation of the 100% of the equity of a RIA. Like the understanding of the Purpose of the Appraised in relation to the Levels of Value (Table B above), RIA shareholders should be familiar with the appraisal’s Risk Managers, stakeholders should review and update their plans annually. This review should include seeking the advice from your attorney, advisors and selected business appraiser. As discussed above there are many reasons for having an appraisal performed and proper prior planning prevents needless acrimony and litigation. Many multi partner RIAs have annual appraisals performed to inform the ownership group on the value of their respective holdings. Working closely with a qualified business appraiser will create lasting value for your firm as possible future issues and questions around value are mitigated by regular understand of firm’s market value.

If you would like to discuss this article or your valuation needs, please contact James S. Arogeti at (312) 238-8690.

corporatevaluationservices.com

Offices in Chicago & Naples

Case Capsule Opinion provided by: Tony Garvy, ASA, CPA/ ABV /CFF, CVA, CDFA, FCPA ([email protected]) is President of Corporate Valuations Services, Inc. and James Arogeti, CFA, CVA ([email protected]) is Manager of Corporate Valuation Services, Inc.

|C|V|S|